EasyAUM’s approach to addressing our client’s business needs is based on three foundational principles:

1. Offer products and technologies that translate to real-world solutions.

2. Integrate fully with existing infrastructure to maximize functionality.

3. Provide project and advisory services that offer best in class implementations, minimizing overhead and maximizing ease of use.

Products

EasyAUM offers proven applications for investment management firms, which adhere to established enterprise data management principles. We provide targeted solutions for business-critical functions – operations, portfolio management, compliance, client service and marketing. This approach enables clients to adopt and maintain best practices and bring their operations to the next level.

We thoroughly integrate and debug our offerings to work with clients’ existing technology infrastructure.Our software works seamlessly with best of breed industry technologies and vendors, including but not limited to Bloomberg, Refinitiv, Morningstar, S&P Capital IQ, FactSet, and SS&C Advent. This approach assures improved efficiencies and scalable growth.

We understand that each client is unique. For more than 25 years, our experienced team has designed systems that meet the specialized needs of our clients and address evolving industry standards.

MarketBridge

Automate market data inflows, capture datasets with precision, and monitor market data for ongoing accuracy

UniverseBuilder

Integrate performance data with market datasets to build new models and create factor score reports

PortfolioGuidelines

Create, monitor, and manage investment policy guidelines to ensure overall asset allocation compliance

LiquidityTracking

Create, monitor, and manage liquidity requirements to ensure compliance.

PortView

Create GIPS presentations and comprehensive composite audits

PortfolioLandscape

Create client and household reports, pitch books, fact sheets and RFPs

EasyOPERA

Meet hedge fund reporting standards to convey risk, exposure and performance metrics

EasyFormPF

Streamline data collection to create and submit SEC Form PF with robust access and audit trail controls

Services

EasyAUM provides comprehensive advisory services that complement our product offerings.

Over the years, we have built a rich body of domain and technology expertise. More than 80 investment firms have capitalized on our experience to avoid pitfalls, efficiently maximize their vested resources, and position themselves for growth by implementing best practices.

EasyAUM implementation engagements typically include:

– Product installations

– Enterprise data integration

– Bespoke implementations

EasyAUM advisory engagements can encompass:

– Asset classification, allocation and modelling

– GIPS® assessment, audits and maintenance

– Process improvement

– Operations and technology assessment

Typical Client Engagement

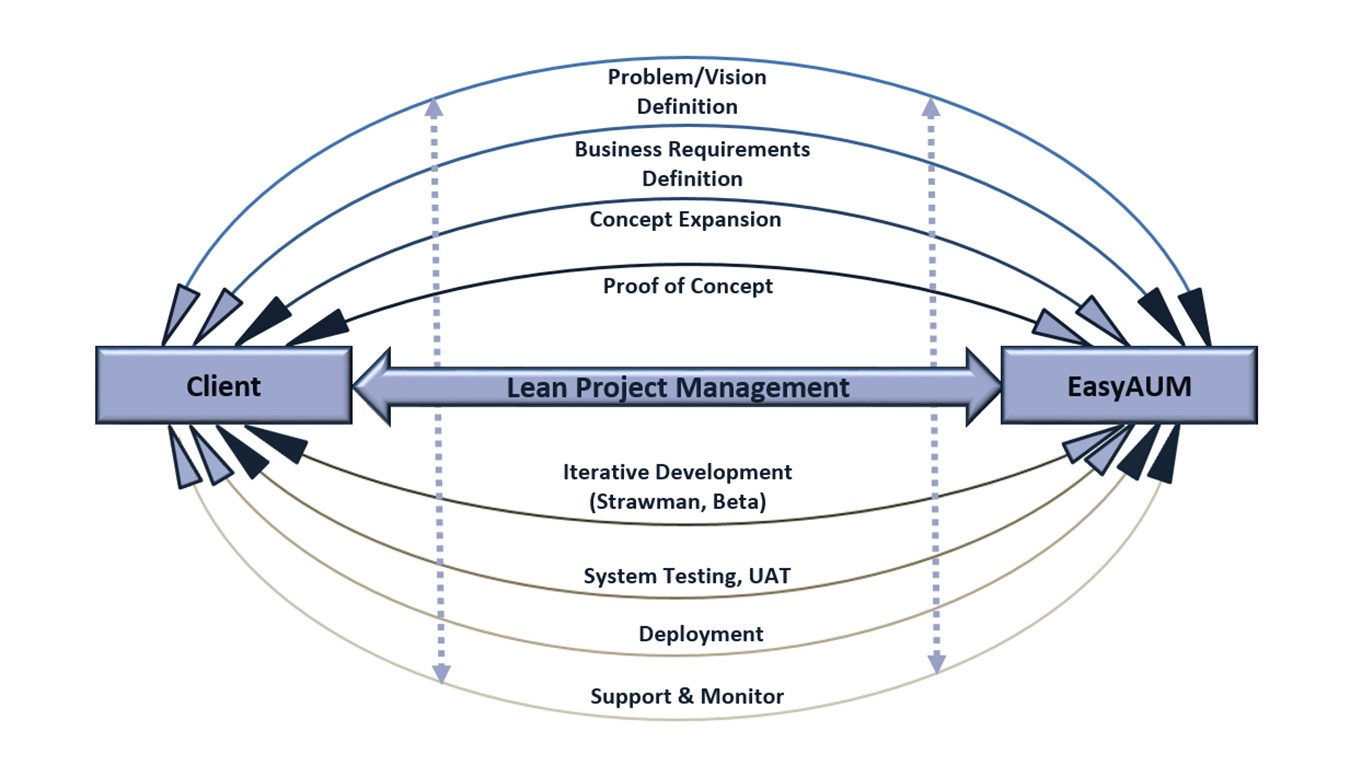

EasyAUM understands that each of our clients has unique needs. Our approach keeps lean project management principles at its core in a collaborative way.

We actively listen to develop and refine an accurate and complete scope of work. Problems and vision are defined, as are business requirements. Concepts are expressed, defined, clarified, expanded, and refined. We work with you to develop an initial proof of concept.

Then we apply iterative development steps that may include straw man and beta implementations. Before deployment, we thoroughly test system components separately and together, following the user acceptance test (UAT) principles. As the system goes live, we provide comprehensive ongoing support and monitoring to assure the system works as intended. Refinements are always possible.

Above all, we seek to bring every project to completion on time and on budget.